|

Bond Video Updates

Bond 2016 Passes, Trustee Seats Filled in May 7 Election - 5/7/16

Richardson ISD's $437 million bond was approved by voters, with 66.98% of those casting ballots in support. The measure will provide new classrooms to accommodate growth, replace or repair aging infrastructure, upgrade classroom technology in every RISD school, and provide equipment to offer more course options to prepare students for college and careers.

"This is a landmark day in Richardson ISD with the passage of the largest bond in our history," said Kim Caston, President of the Board of Trustees. "Today, our community voted to invest in RISD. The passing of Bond 2016 provides our District with the facilities, library enhancements, tools, and technology to prepare our students to compete and be successful in the classroom, on the stage and the field. On behalf of the Board of Trustees, our sincere appreciation to our RISD leadership team, RISD staff, the RISD Community Bond Advisory Group, our RISD parents, students, and community for their input, and all those who worked so hard to help pass this bond. We will continue to work with you to make RISD a 'Destination District.'"

Dr. Stone also thanked the numerous stakeholders who supported the measure, noting that the true winners in this election are Richardson ISD's students and teachers.

"I would like to sincerely thank our parents and community for supporting students, staff and public education in RISD," said Acting Superintendent Dr. Jeannie Stone. "We understand the value and importance of our community's support, and on behalf of our more than 43,000 students and employees, thank you!"

Three Board of Trustee seats also were voted on in Saturday's election:

- Kris Oliver retained his office in Place 3, defeating George Clayton.

- Katie Patterson ran unopposed for Place 4, which was vacated by Lanet Greenhaw following 18 years of service.

- Eron Linn retained his seat in Place 5, after drawing no opponents.

Election results are unofficial until canvassed.

RISD Updates Estimated Tax Rate Increase for Proposed Bond - 5/4/16

Since Bond 2016 information was initially developed in 2015, the projected property tax rate increase has been reported as up to a maximum of 8 cents. Based on more current information, including higher property values and lower interest rates, RISD is updating the estimated tax rate increase associated with the proposed 2016 Bond to approximately 5 cents, which is within the initial parameters of up to an 8 cent maximum increase.

The impact of a 5 cent tax increase on residential homes in RISD at various Dallas Central Appraisal District market values includes:

| Residential Home Value |

Annual Tax Increase |

| $100,000 |

$32.50 |

| $220,758 |

$86.84 |

| $250,000 |

$100.00 |

| $400,000 |

$167.50 |

Background

As part of the bond planning process in early 2015, RISD calculated how bond packages of differing dollar amounts would impact the property tax rate in an effort to aid the RISD Board of Trustees and stakeholders in understanding the effect that bond packages of varying amounts would have on taxpayers.

The different financial scenarios were calculated using conservative assumptions on variables such as taxable value growth, interest rates, and maximum debt issue amounts per year. This data was used to determine the maximum debt tax rate increase and maximum projected interest expenses as part of the proposed 2016 Bond.

Since the maximum financial scenarios were calculated, some of the variables have changed, causing the projected increase in the debt tax rate and the total projected interest expense to change, including:

- The maximum initial calculation from a year ago included a 5% interest rate for the first year issue of bonds, but current rates would be approximately 3.5%

- The maximum initial calculation from last year included projected taxable value growth of less than 2%, and preliminary estimates received from the Dallas Central Appraisal District in April indicate a growth in taxable value of closer to 4%. Approximately half of taxable properties in RISD are residential and half are commercial.

The updated variables reflecting more current information compare favorably to the initial maximum calculation from 2015, which means that the impact on the debt tax rate and RISD taxpayers will be lower than initially projected if Bond 2016 were to be approved by voters. The more current information indicates a projected increase in the debt tax rate of about 5 cents, which is within the parameters of the maximum increase of 8 cents initially projected last year.

RISD is retaining the conservative estimates for interest rates and property values for future years in the revised projection, and will continue to update the calculation as the variables change over time. This would minimize the impact on taxpayers while retaining the proposed bond amount and maintaining RISD’s aggressive debt repayment schedule.

Trustees Call Bond Election For May 7

At their February 15 meeting, RISD trustees voted unanimously to call a $437.1 million bond election for May 7.

"Families are continuing to choose our community to educate their children," said Superintendent Dr. Kay Waggoner. "From the beginning of our bond planning process a year ago, we have been focused on what we believe is best for our students, and I am very comfortable that this bond package reflects that focus."

"Tonight we are asking the RISD community to continue their investment in our students to provide the tools, technology and facilities they need in order to help prepare them to be successful in their global world," said Board President Kim Caston.

The single proposition bond package is broken down into three main categories:

Maintenance of existing infrastructure, technology & equipment - $215.71 million

This category includes capital items that have reached or are expected to reach end of useful life by 2021. Examples include roofs, HVAC units, student & teacher computer devices, and equipment for instructional and extra curricular programs. This category also includes maintenance and upgrades of safety & security equipment such as cameras, alarms and fire protection.

Construction, capacity & renovation - $107.27 million

This category includes new construction of classrooms and capital expenses to increase classroom capacity to accommodate enrollment growth and address outdated design, including:

- $59.74 million would construct 24 classrooms at Lake Highlands H.S., 21 classrooms at Richardson H.S. and redesign/renovate three 1970s-era schools, Aikin, Prestonwood and Yale.

- $47.53 million would accommodate additional enrollment needs over the next five years, potentially including purchase of land, a new elementary school to address enrollment growth in the Lake Highlands area, construction of new classrooms at existing schools and/or purchase of portable classrooms. A community reflector group is expected to submit specific recommendations to the RISD board in April regarding measures to accommodate growth in the Lake Highlands area.

Enrichments - $114.1 million

This category includes items and construction to improve the overall educational experience of students and/or enrich the teaching experience for staff, including:

- $59.98 million - Multipurpose Activity Center at each high school

- $19.42 million - Technology enhancements for RISD classrooms

- $17.19 million - Transformation of libraries at each school into flexible learning environments

- $9.88 million - Additional Career Technology courses and JROTC program at each high school

- $6.13 million - Curriculum & Instruction materials

- $1.5 million - Enterprise technology (business information systems, servers, hardware)

If approved by voters, the bond package would increase the debt service tax rate by an amount not to exceed 8 cents, which equates to a property tax increase of approximately $138.95 a year ($11.58 a month) for an average residential home in RISD valued at $220,758.

Because it is among the few districts to still offer taxpayers a local optional homestead exemption, RISD currently has the third lowest tax levy among the 28 school districts in Dallas and Collin counties for residential homeowners. If the bond package were approved, RISD's tax levy would remain the third lowest for residential homeowners.

RISD will hold community informational meetings in each high school feeder pattern in March & April. |

|

|

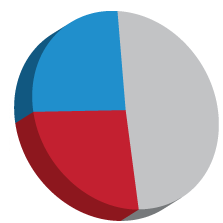

| Proposed Bond Expenditures |

|

|

|

|

|

Capacity/Construction: $107.27M |

|

|

|

|

|

|

| Note: Funding for the proposed RISD 2016 bond program, if approved, will come from the sale of general obligation bonds. These bonds, in school districts, are intended to furnish and equip school buildings and programs. The proposed items in the program draft reflect the items RISD expects to address in the 2016 bond program. However, under the governing rules, the proposed budget amount assigned to anticipated projects is an estimate and may vary or be redistributed based upon need. |

|

|

|

|

|