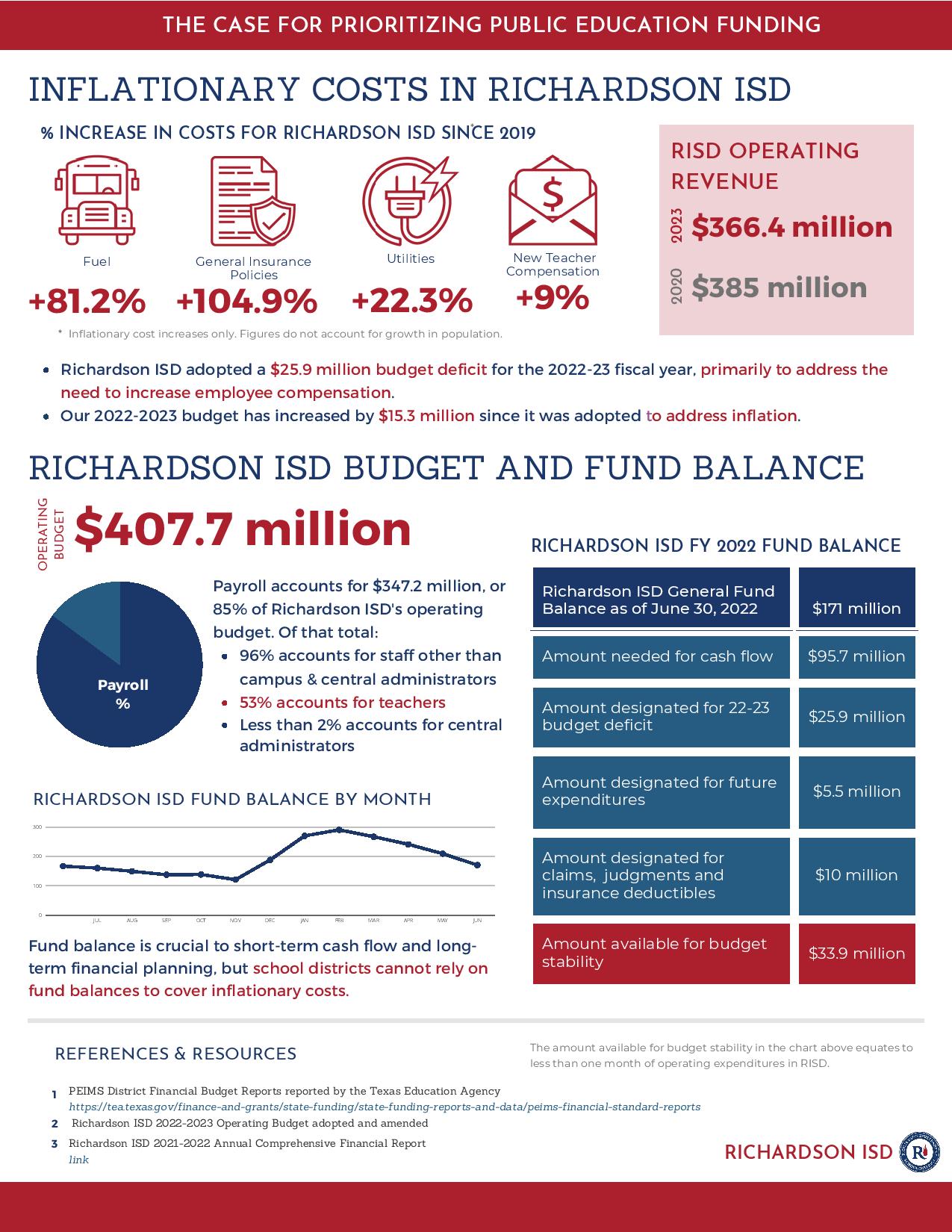

Concluding a process that began in January, RISD Trustees approved the district’s 2023-24 budget at the June 8 regular meeting. The approved operating budget is based on an anticipated state-set operating tax rate of $0.9335, a reduction from the current year rate and at the lowest level since 1993. The Texas legislature is widely expected to adopt some form of property tax relief this summer, which would reduce the operating tax rate further. The adopted operating budget includes a $14.8 million deficit that will be funded through one-time use of the district’s fund balance, and also includes $14.4 million in reductions and efficiencies, realized through not budgeting at full employment, central cuts, and reducing allocations to reflect decreased student enrollment. The budget includes an aggressive teacher raise and staff compensation package to remain competitive in the North Texas market. Trustees also formally commissioned the creation of a community budget steering committee to assist the district with prioritizing limited resources and decisions for 2024-25 budget planning.

“This budget achieves our highest priority heading into the budget planning process – retaining and rewarding our teachers and staff,” said RISD Superintendent Tabitha Branum. “We have made strides to reduce spending in ways that don’t impact the quality of our classroom instruction, and will continue with those efforts. With that said, we are facing some fundamental decisions in the coming year about RISD’s operational model, given reduced enrollment in our district and across Texas, and our high number of open classroom seats. With the help of our community budget steering committee, we will work to identify additional ways to operate more efficiently and also increase district revenue. Our commitment to maintaining safe campuses, student academic growth, and attracting and retaining outstanding educators will not change.”

Other highlights of the adopted budget include:

- The budget does not include any additional per-student revenue from the Texas legislature. Lawmakers have not increased the basic per-student allotment to public school districts since before the pandemic (2019). The state has a historically-high budget surplus, and has set up a school funding system that funnels the benefit of additional tax dollars paid by RISD property owners due to increased home/property values to the state, not the local school district.

- The debt service tax rate (the portion of the property tax rate that finances voter-approved bonds) remains unchanged at $0.35 for the 8th year.

- The 2023-24 budget is the 4th consecutive deficit budget adopted by RISD, including the 2022-23 operating budget that included a deficit of $25.9 million.

- The budget includes continued funding for RISD’s local optional homestead exemption – an optional tax break that the district provides taxpaying homeowners. RISD is one of the three remaining school districts out of the 37 in Dallas and Collin counties to still offer the optional tax break, at a cost of $7.8 million.

- The district’s fund balance, (similar to a household’s savings/checking account) will be spent to make up deficit in the 2023-24 budget. The fund balance is used to pay district expenses (like payroll, utilities, and fuel) each month when property tax collections and state funding are insufficient to cover operating costs, and the state of Texas sets a target percentage for school district fund balances. RISD is projected to reach the minimum percentage to efficiently operate in 2024-2025, which limits the district’s ability to adopt another deficit budget.

- RISD residents interested in serving on or nominating someone for the community budget steering committee are encouraged to express interest through this online form.

Watch the 2023-24 budget presentation and discussion/adoption at the June 8 regular meeting.